When starting a business in India, choosing the right type of company structure is one of the most important decisions you’ll make. It impacts everything from taxes to liability and the legal requirements you’ll need to fulfil. This blog will break down the types of companies in India in a simple and easy to understand way, helping you decide which structure might be the best for your business.

Let’s Breakdown together!

Why Choosing the Right Company Structure is Important?

Choosing the right type of company is crucial because it influences:

- How much tax you’ll pay.

- Your legal obligations.

- The extent of your personal liability.

- Your ability to raise capital.

- Future expansion possibilities.

Now, let’s dive into the different types of companies in India and what they mean for your business.

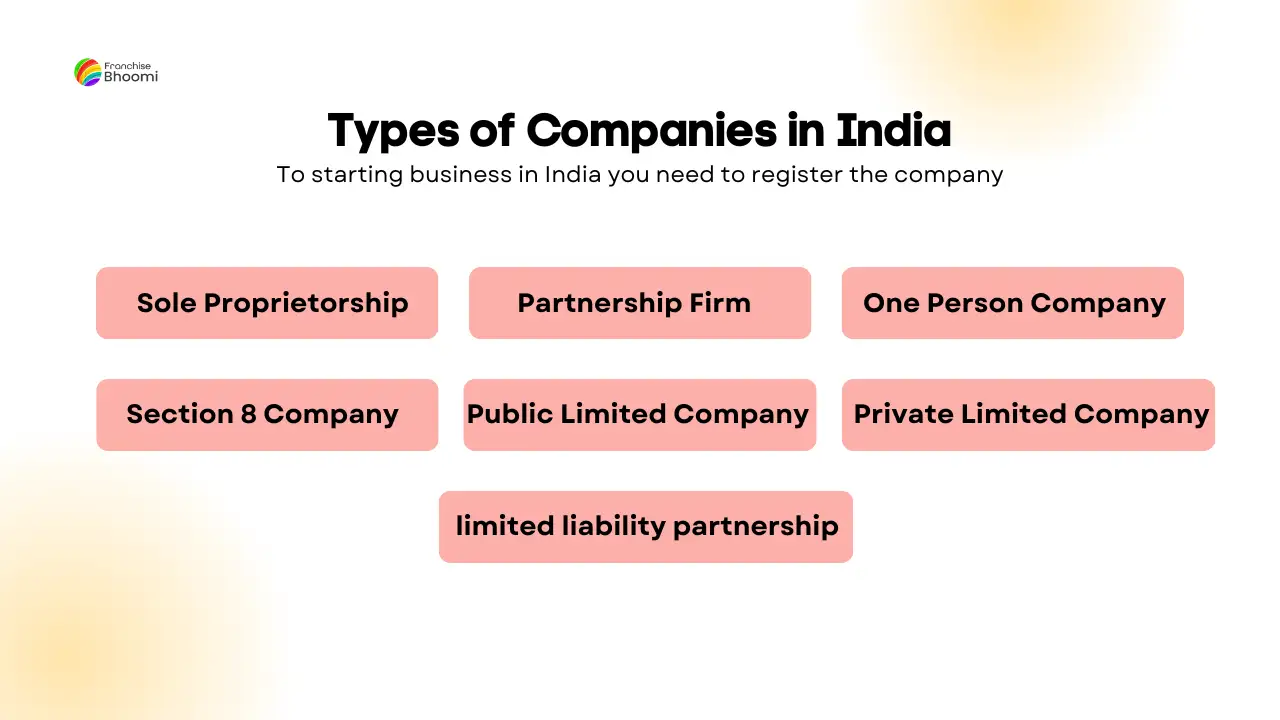

Listing out Types of Companies in India

Sole Proprietorship

A sole proprietorship is the simplest & easy form of business to start, owned and operated by a single individual. It requires minimal legal formalities and offers complete control to the owner. This structure is ideal for small businesses or freelancers. However, the owner has unlimited personal liability for business debts.

| Feature | Description |

| Ownership | Single owner |

| Liability | Unlimited personal liability |

| Taxation | Taxed as personal income |

| Legal Formalities | Minimal, no need for registration |

| Ideal for | Small businesses or freelancers |

Partnership Firm

A partnership firm involves two or more individuals who share the profits and losses of the business. It is relatively easy to set up and manage, making it suitable for small to medium-sized businesses. Partners have unlimited personal liability unless they form a Limited Liability Partnership (LLP).

| Feature | Description |

| Ownership | Owned by 2 or more partners |

| Liability | Unlimited (can be limited in LLP) |

| Taxation | Taxed as personal income of partners |

| Legal Formalities | Partnership deed required |

| Ideal for | Small to medium-sized businesses |

Limited Liability Partnership (LLP)

An LLP combines the flexibility of a partnership with the limited liability of a corporation. It is ideal for professionals and consultants, providing protection from personal liability while allowing for easier management and compliance compared to private companies.

| Feature | Description |

| Ownership | Partners (minimum 2) |

| Liability | Limited to the extent of the investment |

| Taxation | Taxed as partnership income |

| Legal Formalities | Registered under LLP Act, 2008 |

| Ideal for | Professional services, consultants |

Private Limited Company (Pvt Ltd)

A Private Limited Company is a popular choice for startups and growing businesses. It allows for limited liability, meaning shareholders are only liable for the amount invested in the company. This structure facilitates raising capital through shares but involves more regulatory compliance.

| Feature | Description |

| Ownership | Shareholders (2-200) |

| Liability | Limited to the value of shares |

| Taxation | Corporate tax rate |

| Legal Formalities | Must register under the Companies Act |

| Ideal for | Growing businesses, startups |

Public Limited Company

A Public Limited Company can issue shares to the public, making it suitable for large businesses looking to raise significant capital. Shareholders have limited liability, but the company must adhere to stringent regulatory requirements and disclosures.

| Feature | Description |

| Ownership | Public shareholders (minimum 7 owners) |

| Liability | Limited to the extent of shares |

| Taxation | Corporate tax rate |

| Legal Formalities | Must comply with SEBI regulations |

| Ideal for | Large businesses looking to expand |

One Person Company (OPC)

An OPC is designed for solo entrepreneurs who want the benefits of a corporate structure with limited liability. It allows a single individual to own and manage the company while enjoying protection from personal liability, but it cannot raise equity funding.

| Feature | Description |

| Ownership | Single owner |

| Liability | Limited to the extent of shares |

| Taxation | Corporate tax rate |

| Legal Formalities | Registration required under Companies Act |

| Ideal for | Solo entrepreneurs |

Section 8 Company

A Section 8 Company is a non-profit organization focused on promoting charitable or social objectives. It is exempt from income tax on funds used for its charitable activities but must follow strict regulations and cannot distribute profits to members.

| Feature | Description |

| Ownership | Managed by trustees or board members |

| Liability | Limited to the value of the company’s assets |

| Taxation | Exempt from taxes (subject to conditions) |

| Legal Formalities | Must register under the Companies Act |

| Ideal for | Charitable, social, and nonprofit organizations |

Hindu Undivided Family (HUF)

An HUF is a unique structure available only to Hindu families. It allows family members to operate a business collectively with tax benefits, but the Karta (head of the family) holds significant responsibility and authority. It is best suited for family-run businesses.

| Feature | Description |

| Ownership | Family members (led by Karta) |

| Liability | Unlimited for Karta, limited for members |

| Taxation | Taxed as a separate entity |

| Legal Formalities | Minimal, formed under Hindu law |

| Ideal for | Family-run businesses |

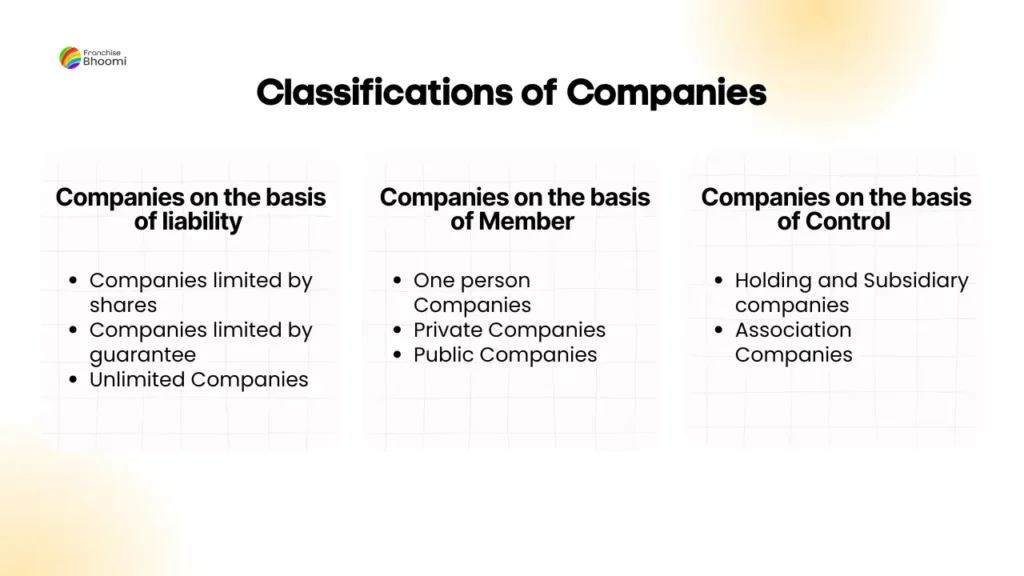

| Classification | Types of Companies |

|---|---|

| Based on the number of members | – Private Limited Company – Public Limited Company – One Person Company (OPC) |

| Based on the liability of the members | – Companies Limited by Guarantee – Companies Limited by Shares – Unlimited Company |

| Based on the size | – Micro Companies – Small Companies – Medium Companies |

| Based on control | – Holding Company – Subsidiary Company |

| Based on access to capital | – Listed Company – Unlisted Company |

| Based on ownership | – Government Company – Foreign Company – Associate Company – Section 8 Company – Dormant Company |

Choosing the Right Type of Companies

When choosing the type of company to establish, it is essential to consider various factors such as:

- The nature of the business activities

- The duration of the investment and the business model

- Tax considerations

- Any residency considerations for foreign investors

- The level of liability protection required

For Example, a sole proprietorship may be suitable for a small business with low risk, while a private limited company may be more appropriate for a business seeking to attract investors and limit liability. A foreign company may choose to establish a wholly owned Indian subsidiary to engage in business activities permitted under the foreign direct investment policy.

Read More: How to Choose the Right Type Company Entity in India

Conclusion

Choosing the right type of company is one of the most crucial decisions for any business in India. Whether you’re a solo entrepreneur starting small, a growing business looking for investment, or a charitable organization aiming to make an impact, understanding the different company structures is essential.

Each type, whether it’s a Sole Proprietorship, LLP, Private Limited Company, or Section 8 Company—has its own advantages and limitations. By selecting the business structure that aligns with your goals, liability preferences, and long-term vision, you can set the foundation for success. Make sure to assess your needs carefully and seek professional advice if needed to ensure you’re on the right path.

PS: Please help me improve my content, share your feedback by clicking any of the emojis below 👇

Pingback: How to Choose the Right Type Company Entity in India