In today’s fast-paced business environment, accuracy and speed are crucial, especially when it comes to financial calculations. Whether you’re a franchise owner, small business operator, or budding entrepreneur, ensuring that your taxes are correctly calculated is vital for compliance and profitability. One such tax that plays a significant role in Indian commerce is the Goods and Services Tax (GST). To simplify this process, we bring you a Free GST Calculator Tool that instantly calculates your GST amount and final price, making it easier than ever to stay on top of your tax responsibilities.

What is GST?

GST (Goods and Services Tax) is an indirect tax system implemented in India to bring all indirect taxes under one umbrella. Introduced on July 1, 2017, GST replaced various other taxes like VAT, Service Tax, Excise Duty, and others. It is designed to create a unified market and eliminate the cascading effect of taxes.

GST is primarily divided into three categories:

- CGST (Central Goods and Services Tax): Collected by the central government on intra-state transactions.

- SGST (State Goods and Services Tax): Collected by the state government on intra-state transactions.

- IGST (Integrated Goods and Services Tax): Collected by the central government on inter-state transactions.

These components together ensure that both the central and state governments get their fair share of tax revenue.

Why is GST Important for Businesses?

Understanding and calculating GST is essential for every business in India. Here’s why:

- Simplification of Taxes: GST replaces multiple indirect taxes with one unified system.

- Transparency: Every stage of the supply chain is taxed, and input tax credit is available.

- Reduced Tax Burden: Consumers benefit from lower overall tax rates due to the elimination of the cascading effect.

- Boost to Indian Economy: A common national market facilitates trade and boosts the economy.

For franchises and small businesses, GST compliance not only keeps them out of legal trouble but also boosts credibility and professionalism.

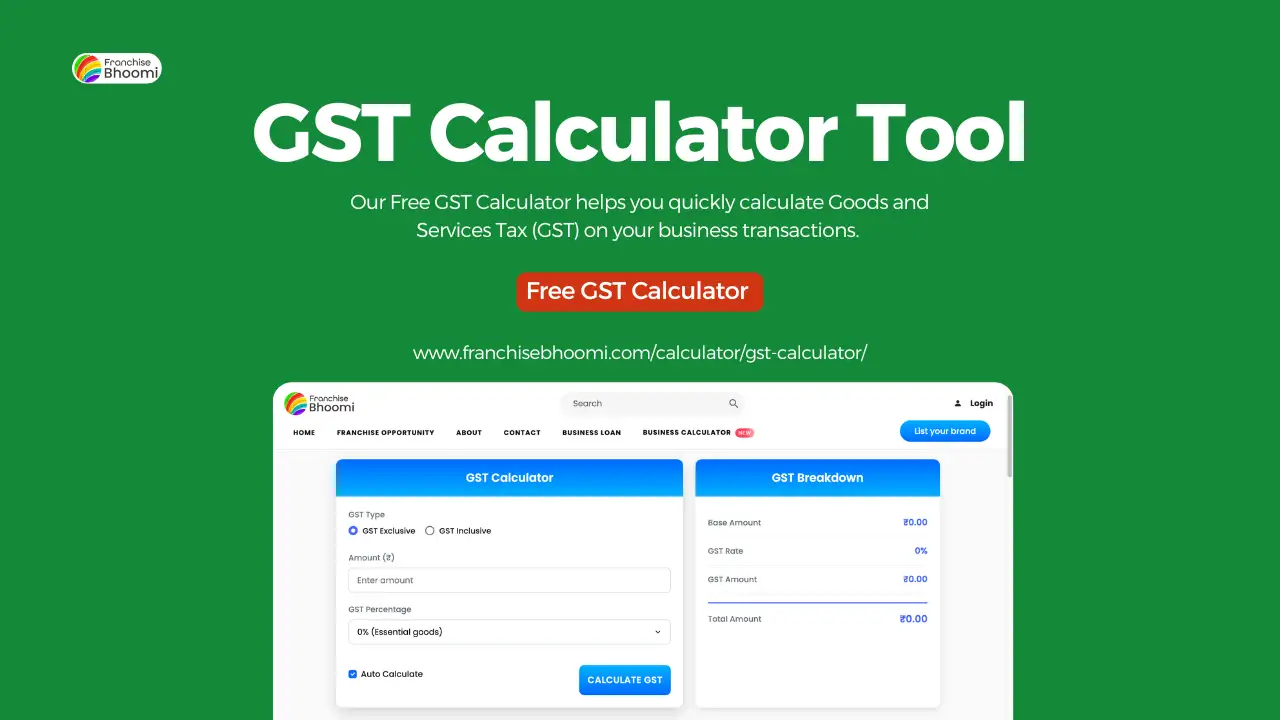

How to Use Our Free GST Calculator Tool

Our online GST calculator is designed to be user-friendly and efficient. Here’s how you can use it:

- Enter the Base Amount: Input the original price of the product or service.

- Select GST Rate: Choose from common GST slabs – 5%, 12%, 18%, or 28%.

- Choose Type: Select whether GST is inclusive (already included in price) or exclusive (to be added to the base price).

- Click ‘Calculate’: Instantly get the GST amount and the final price.

This tool is perfect for those who want accurate results without diving into complex formulas.

Understanding GST Rates in India

GST rates in India vary depending on the product or service:

- 5% GST: Applies to essential items like packaged food, dairy products, and life-saving medicines.

- 12% GST: Includes processed foods, mobile phones, and business class air tickets.

- 18% GST: Applies to most goods and services including IT services, restaurants, and consumer electronics.

- 28% GST: Reserved for luxury goods like automobiles, tobacco products, and high-end electronics.

Businesses must be aware of these categories to ensure accurate tax calculation and avoid penalties.

Benefits of Using the Free GST Calculator Tool

- Time-Saving: Instant results reduce time spent on manual calculations.

- User-Friendly: Designed for anyone, regardless of their financial knowledge.

- Error-Free Calculations: Automated computation ensures accuracy.

- Multiple Use Cases: Useful for invoices, receipts, and estimates.

This tool is especially useful for:

- Retailers calculating tax on MRP.

- Service providers adding GST to invoices.

- Customers verifying GST on bills.

- Traders maintaining tax compliance.

Example Scenarios

Let’s explore a few real-world examples where our GST calculator comes in handy:

Scenario 1: Franchise Owner Selling Beverages

Suppose you sell beverages priced at ₹600. You select 18% as the GST rate. By choosing ‘Exclusive’ GST, the calculator shows:

- GST Amount: ₹108

- Final Price: ₹708

Scenario 2: Customer Buying Mobile Phone

You buy a mobile phone for ₹12,000 (inclusive of 12% GST). Selecting ‘Inclusive’ option and 12% rate, the calculator gives:

- GST Amount: ₹1,285.71

- Base Price: ₹10,714.29

These instant calculations help you make smarter business decisions.

Who Should Use the Online GST Calculator?

Our Free GST Calculator Online is useful for a wide audience:

- Business Owners: To add the right GST in quotes, invoices, and pricing.

- Freelancers: To determine GST applicable on services offered.

- Customers: To validate if the GST charged on bills is correct.

- Traders and Retailers: For stock management and pricing strategy.

Conclusion

Tax compliance doesn’t have to be difficult. With our Free GST Calculator Tool, anyone from small business owners to individual buyers can easily calculate GST amounts in seconds. It’s accurate, quick, and hassle-free – saving you time and preventing costly mistakes. Use our tool today to simplify your billing, pricing, and tax calculations. Let it be your go-to solution for managing GST the smart way.

Stay compliant. Stay confident. Use our Free GST Calculator now!

PS: Please help me improve my content, share your feedback by clicking any of the emojis below 👇

Frequently Asked Questions (FAQs)

Yes, it is 100% free and can be used unlimited times.

Currently, it calculates total GST. Future versions will break it down into IGST, CGST, and SGST.

Absolutely! You can toggle between inclusive and exclusive modes.

Yes, it supports all standard GST rates. You just need to know the correct rate for your product or service.

I like how this tool focuses on real-time results. It’s especially useful for franchise owners juggling multiple transactions daily and needing instant clarity on their pricing.