If you’re looking to start or expand your small business, the Pradhan Mantri Mudra Yojana (PMMY) could be a great financing option. This government-backed scheme helps micro and small enterprises with loans of up to Rs. 10 lakhs. So, if you’re curious about how Mudra loan work and how they can benefit your business, you’re in the right place!

Let’s get breakdown the things

What is the Mudra Loan Scheme?

The Pradhan Mantri Mudra Yojana (PMMY) is a loan scheme introduced by the Government of India to support small businesses financially. Mudra loans are specially designed for non-corporate, non-farm small/micro enterprises involved in income-generating activities like manufacturing, trading, and providing services.

With a Mudra loan, you can get funds for your business needs without any collateral requirement, making it accessible for entrepreneurs who might struggle to get traditional bank loans.

Key Features of Mudra Loans

Here’s a look at some of the main features of the Mudra loan scheme, so you can see if it’s a fit for you:

Loan Categories

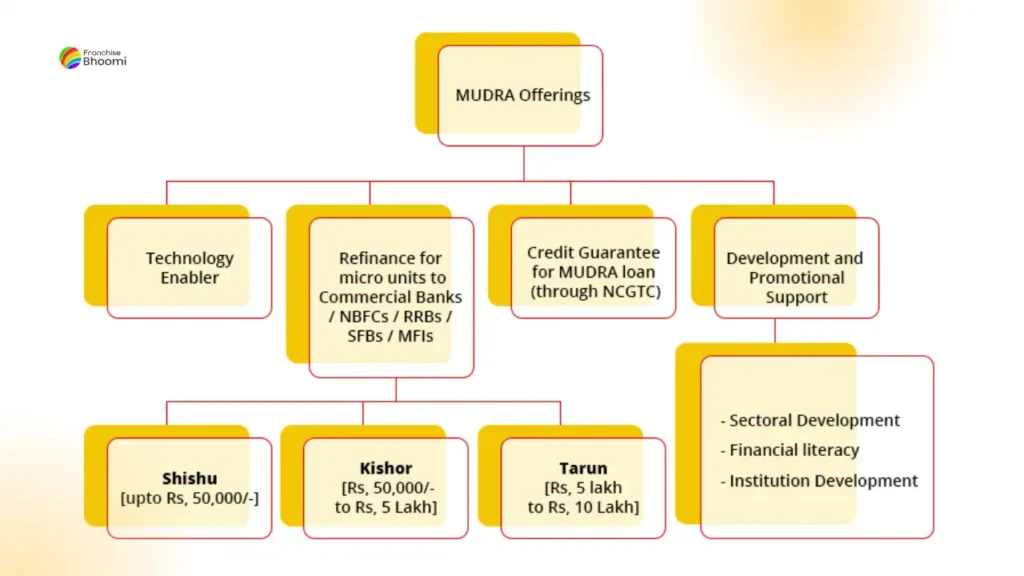

Mudra loans are divided into three categories based on the business stage and funding needs. Here’s a breakdown:

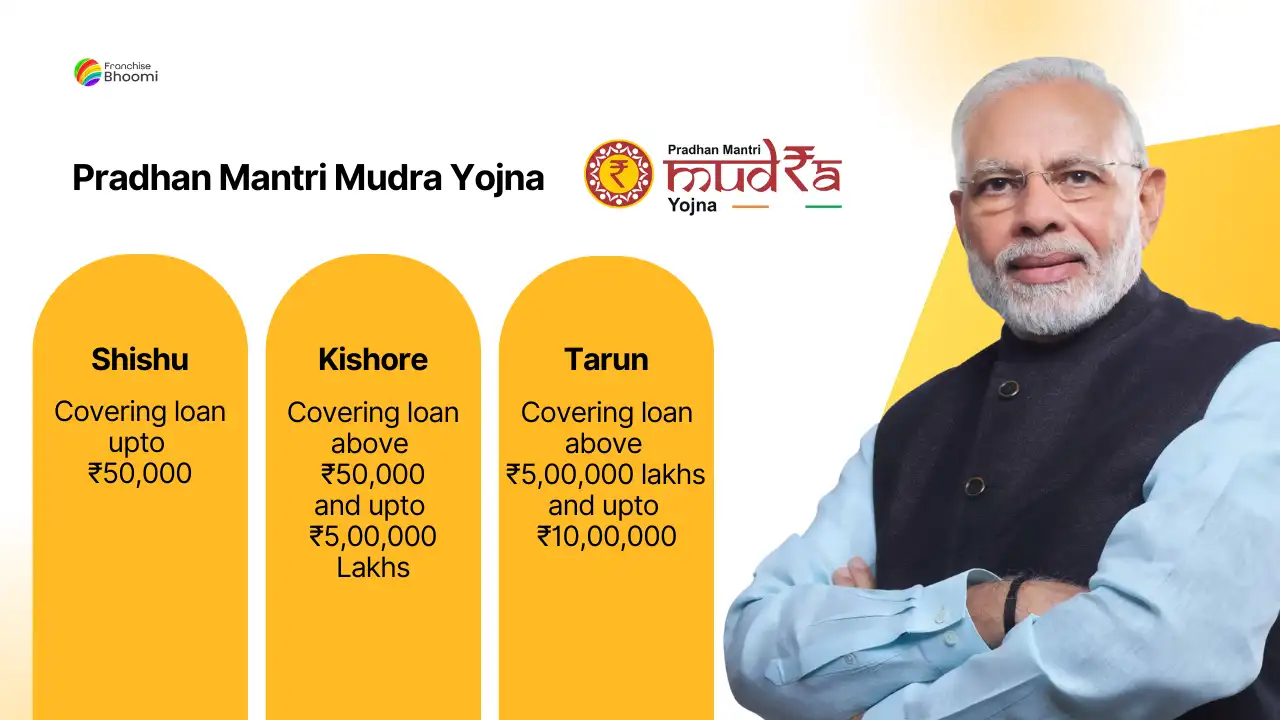

- Shishu: For new businesses that need funds up to Rs. 50,000.

- Kishore: For slightly established businesses needing funds from Rs. 50,001 to Rs. 5 lakhs.

- Tarun: For businesses needing larger funding between Rs. 5 lakhs and Rs. 10 lakhs.

| Shishu : covering loans upto 50,000/- |

| Kishor : covering loans above 50,000/- and upto 5 lakh |

| Tarun : covering loans above 5 lakh and upto 10 lakh |

These categories are designed to cater to different business needs, from startup costs to expansion funds.

Eligible Borrowers

The Mudra loan is available to various types of borrowers, including:

- Individual business owners

- Proprietorships

- Partnership firms

- Private and public companies

- Other legal entities engaged in income-generating activities

Application Process

Applying for a Mudra loan is easy. Here’s what you need to do:

- Visit the Udyamimitra portal and fill out an online application, or

- Apply at any nearby bank branch, NBFC (Non-Banking Financial Company), or MFI (Micro Finance Institution).

Repayment Options

Mudra loans have flexible repayment terms. The loan amount is typically repaid in Equated Monthly Installments (EMI), making it manageable for small businesses to repay over time.

Who Offers Mudra Loans?

Mudra loans are widely accessible, thanks to the number of financial institutions partnered with the PMMY scheme. Here’s a quick list of institutions where you can apply for a Mudra loan:

- Public Sector Banks: 27 banks

- Private Sector Banks: 18 banks

- Regional Rural Banks (RRBs): 31 banks

- Co-operative Banks: 14 banks

- NBFC-MFIs: 47 institutions

- MFIs: 26 institutions

- NBFCs: 31 companies

In total, 194 financial institutions are offering Mudra loans, so finding a lender near you is easy.

List of Banks – MUDRA loan

Public sector banks & Private Sector banks

| Public Sector Banks | Private Sector Banks |

|---|---|

| State Bank of India | Axis Bank Ltd. |

| State Bank of Bikaner & Jaipur | Catholic Syrian Bank Ltd. |

| State Bank of Travancore | City Union Bank Ltd. |

| Bank of Baroda | DCB Bank Ltd. |

| Bank of India | Federal Bank Ltd. |

| Bank of Maharashtra | HDFC Bank Ltd. |

| Canara Bank | ICICI Bank Ltd. |

| Corporation Bank | IndusInd Bank Ltd. |

| Dena Bank | Jammu & Kashmir Bank Ltd. |

| IDBI Bank Ltd. | Karnataka Bank Ltd. |

| Indian Bank | Karur Vysya Bank Ltd. |

| Oriental Bank of Commerce | Kotak Mahindra Bank Ltd. |

| Punjab National Bank | Nainital Bank Ltd. |

| Syndicate Bank | South Indian Bank |

| UCO Bank | Tamilnad Mercantile Bank Ltd. |

| Union Bank of India | The Ratnakar Bank Ltd. |

| Vijaya Bank | Yes Bank Ltd. |

| Allahabad Bank | IDFC Bank Ltd. |

| Andhra Bank | |

| Bhartiya Mahila Bank | |

| Central Bank of India | |

| Indian Overseas Bank | |

| Punjab & Sind Bank | |

| State Bank of Hyderabad | |

| State Bank of Mysore | |

| State Bank of Patiala | |

| United Bank of India |

Regional Rural Banks (RRBs) & Co-operative Banks

| Regional Rural Banks (RRBs) | Co-operative Banks |

|---|---|

| Andhra Pragathi Grameena Bank | Gujarat State Co-op Bank Ltd |

| Chaitanya Godavari Grameena Bank | Mehsana Urban Co-op Bank |

| Deccan Grameena Bank | Rajkot Nagarik Sahhakari Bank |

| Saptagiri Grameena Bank | Kalupur Commercial Co-op Bank |

| Bihar Gramin Bank | Bassein Catholic Co-op Bank |

| Madhya Bihar Gramin Bank | TJSB Sahakari Bank Ltd |

| Uttar Bihar Gramin Bank | Jalgaon Janata Sahakari Bank Ltd |

| Baroda Gujarat Gramin Bank | Nutan Nagrik Sahakari Bank Ltd |

| Dena Gujarat Gramin Bank | Ahmedabad Mercantile Co-op Bank Ltd |

| Saurashtra Gramin Bank | Surat People Co-op Bank Ltd |

| Kaveri Grameena Bank | Dombivali Nagari Sahakari Bank Ltd |

| Karnataka Vikas Grameena Bank | Citizen Credit Co-op Bank Ltd |

| Pragathi Krishna Gramin Bank | Tamil Nadu Apex State Co-op Bank Ltd |

| Kerala Gramin Bank | AP State Apex Co-op Bank Ltd |

| Maharashtra Gramin Bank | |

| Meghalaya Rural Bank | |

| Puduvai Bharathiar Grama Bank | |

| Malwa Gramin Bank | |

| Punjab Gramin Bank | |

| Sutlej Gramin Bank | |

| Marudhara Gramin Bank | |

| Pallavan Grama Bank | |

| Pandyan Grama Bank | |

| Tripura Gramin Bank | |

| Baroda Uttar Pradesh Gramin Bank | |

| Prathama Gramin Bank | |

| Sarva UP Gramin Bank | |

| Narmada Jhabua Gramin Bank | |

| Sarva Haryana Gramin Bank | |

| Kaveri Grameena Bank | |

| Baroda Rajasthan Kshetriya Gramin Bank |

Microfinance Institutions (MFIs), MFI-NBFCs, and Mainline NBFCs

| Microfinance Institutions (MFIs) | MFI-NBFCs | Mainline NBFCs |

|---|---|---|

| Bhartiya Micro Credit | S V Creditline Pvt. Ltd. | Reliance Capital Ltd. |

| Sakhi Samudaya Kosh | Margdarshak Financial Services Ltd. | Fullerton India Credit Co. Ltd. |

| Cashpor Micro Credit | Madura Micro Finance Ltd. | Shriram Transport Finance Co. Ltd. |

| CDOT (Society) | ESAF Micro Finance & Investments | SREI Equipment Finance Ltd. |

| Mahana Foundation (Trust) | Fusion Micro Finance P. Ltd | Magma Fincorp Ltd. |

| IRCED (Society and Trust) | Ujjivan Financial Services P. Ltd | Religare Finvest Ltd. |

| NEED | Future Financial Services Ltd. | Shriram City Union Finance Ltd. |

| Community Collective Society for Integrated Development | SKS Microfinance Ltd. | Equitas Finance P. Ltd. |

| Swayam Micro Services | Utkarsh Micro Finance P. Ltd | India Infoline Ltd. |

| Chanura Microfin Manipur | Equitas Micro Finance Ltd | ECL Finance Ltd. |

| Humana People to People India | Sonata Finance Pvt. Ltd | AU Financiers India Ltd. |

| Disha India Micro Credit | Saija Finance Private Ltd | SE Investments Ltd. |

| Annapurna Mahila Multistate Co-op Credit Society | Arth Micro Finance Pvt. Ltd | Electronica Finance Ltd. |

| Prayas (Organisation for Sustainable Development) | Shikhar Microfinance Pvt. Ltd | MAS Financial Services Ltd. |

| Dhosa Chandaneshwar Bratyajana Samity | Navachetana Microfin Services | IKF Finance Ltd. |

| Seba Rahara (Society) | Samasta Microfinance Ltd. | Intec Capital Ltd. |

| Belghoria Janakalyan Samity | Satin Credit Care Network Ltd | Sakthi Finance Ltd. |

| Gram Bikash Kendra | Sahyog Microfinance Ltd | Esskay Auto Finance Ltd. |

| Shakti Mahila Sangh Bahu Uddeshya Sahkari Maryadit | Arohan Financial Services P. Ltd | Bansal Credits Ltd. |

| Mahasemam Trust (Society) | Suryodaya Microfinance Ltd | Five Star Business Credits Ltd. |

| Sampurna Training and Entrepreneurship Programme (STEP) | Belstar Investment & Finance P. Ltd | Indiabulls Financial Services Ltd. |

| Life Foundation | Jagaran Microfin P. Ltd | Vistaar Financial Services P. Ltd. |

| Sanghmitra Rural Financial Services | Digamber Capfin Ltd | Shriram Finance Corporation Pvt Ltd |

| Pahal Financial Services Pvt Ltd | Midland Microfin Ltd | India Infoline Finance Ltd |

| Blaze trust | RGVN (North East) Microfinance Ltd | Mahindra & Mahindra Financial Services Ltd |

| Mahashakti Foundation | Grameen Development & Finance | Pudhuaaru Financial Services Pvt Limited |

| Hindustan Microfinance Pvt Ltd | Nabard Financial Services Ltd | |

| Namra Finance Ltd | Maanaveeya Development & Finance Pvt Ltd | |

| Muthoot Fincorp Ltd | Jumbo Finvest (India) Ltd | |

| Sambandh Finserve Pvt Ltd | Ananya Finance for Inclusive Growth | |

| IDF Financial Services Pvt Ltd | Capital First Limited | |

| Nightingale Finvest Pvt Ltd | ||

| Asirvad Microfinance Pvt Ltd | ||

| Village Financial Services Pvt Ltd | ||

| Janalakshmi Financial Services Pvt Ltd | ||

| YVU Financial Services Pvt Ltd | ||

| Disha Microfin Pvt Ltd | ||

| SMILE Microfinance Ltd | ||

| Light Micro Finance Ltd | ||

| Uttarayan Financial Services Pvt Ltd | ||

| Unacco Financial Services Pvt Ltd | ||

| Varam Capital | ||

| Vedika Credit Capital Ltd |

| Partner Institutions | Nos |

|---|---|

| PUBLIC SECTOR BANKS | 27 |

| Private Sector Banks | 18 |

| REGIONAL RURAL BANKS (RRBs) | 31 |

| Co-operative Banks | 14 |

| MFI-NBFC | 47 |

| MFI | 26 |

| NBFC | 31 |

| Total | 194 |

Why Choose a Mudra Loan?

Mudra loans offer a range of benefits to small business owners. Here’s how they can help you achieve your business goals:

- No Collateral Required: Mudra loans don’t need collateral, which means you don’t have to pledge any assets as security.

- Low Interest Rates: Interest rates are competitive and vary based on the loan category (Shishu, Kishore, or Tarun).

- Flexible Repayment Terms: The EMI structure makes it easier to manage loan payments.

- Wide Eligibility Range: Almost any non-farm small business in manufacturing, trading, or services can apply.

Project Overview Sample for Mudra Loan

Planning to apply for a Mudra loan? You’ll need to submit a project overview, which provides a snapshot of your business and its financial needs. Here’s a sample document to give you an idea of what to include in your project overview.

How to Apply for a Mudra Loan

- Visit the Udyamimitra portal: You can fill out the Mudra loan application online by creating an account on the Udyamimitra portal. Alternatively, visit your nearest bank or NBFC/MFI branch to apply in person.

- Submit Necessary Documents: Typically, you’ll need identity proof, address proof, and details about your business, such as a project plan or a business proposal.

- Await Approval: Once your application is submitted, the bank or financial institution will review it. If your application is approved, you’ll receive the loan amount, which you can use to grow your business.

- Start Repayment in EMIs: Begin paying back the loan in monthly EMIs as per the agreed schedule. The EMI structure makes repayments manageable for small businesses.

Why Mudra Loans Matter for Small Businesses in India

For entrepreneurs and small business owners, securing funding is often the biggest hurdle. With a Mudra loan, you have access to affordable funding that empowers you to start or expand your business without needing collateral. This makes the Mudra loan a powerful tool for anyone with the drive to succeed but limited access to traditional financing.

Whether you’re a startup owner or running a well-established business, a Mudra loan can open up new possibilities for growth and stability. By providing necessary funds with flexible repayment options, Mudra loans support the spirit of entrepreneurship across India.

Conclusion

The Pradhan Mantri Mudra Yojana (PMMY) is more than just a loan scheme—it’s a stepping stone for countless small businesses in India. With its flexible loan categories, affordable interest rates, and lack of collateral requirements, the Mudra loan empowers entrepreneurs to take bold steps toward growth. Whether you’re just starting out or looking to expand, this government-backed loan offers you the support and resources to turn your business aspirations into reality.

If you’re ready to take the next step, a Mudra loan could be the ideal financial boost for you. Explore your options, prepare your business plan, and reach out to the nearest financial institution to start your journey with the Mudra loan today. At Franchise Bhoomi, we’re here to guide you through the process and help you find the best opportunities to grow your business successfully.

Pingback: How to Apply for Shishu Loan (MUDRA Loan) Getup to ₹50,000

Pingback: How to Start PreSchool Business in India

New mobile shop

Pingback: How to Start an Oil Mill Business in India

Mujhe loan chahie house lene ke liye

Tinenaber

Pingback: India Union Budget 2025-2026 | Ministry of Finance

Fielding corrector work

Thanks for information, and thanks for prime Minister

I want loan